Great products fail when teams build on assumptions instead of people. Optimizing Product Development starts with the “why” behind choices and behaviour, then turns that insight into features, pricing, and messages that work. That is where Qualitative Market Research for Product Development fits.

In practice, product development and market research move together in one path: discover consumer insight, test concepts, run prototype and usability testing, validate the offer and message, and go to market with confidence. Along this path you decide feature prioritisation, price sensitivity, user experience fixes, persuasion mapping, and a tight feedback loop for iteration.

To help you do this, Insights Opinion acts as your qualitative market research company and qualitative marketing research agency. We run end-to-end programmes that plug into agile sprints and deliver decision-ready outputs for product, design, and growth.

When you need scale, we coordinate with big market research firms while keeping synthesis and quality central. Our qualitative market research services turn conversations into choices you can build. Read on to follow the exact flow and apply it to your next release.

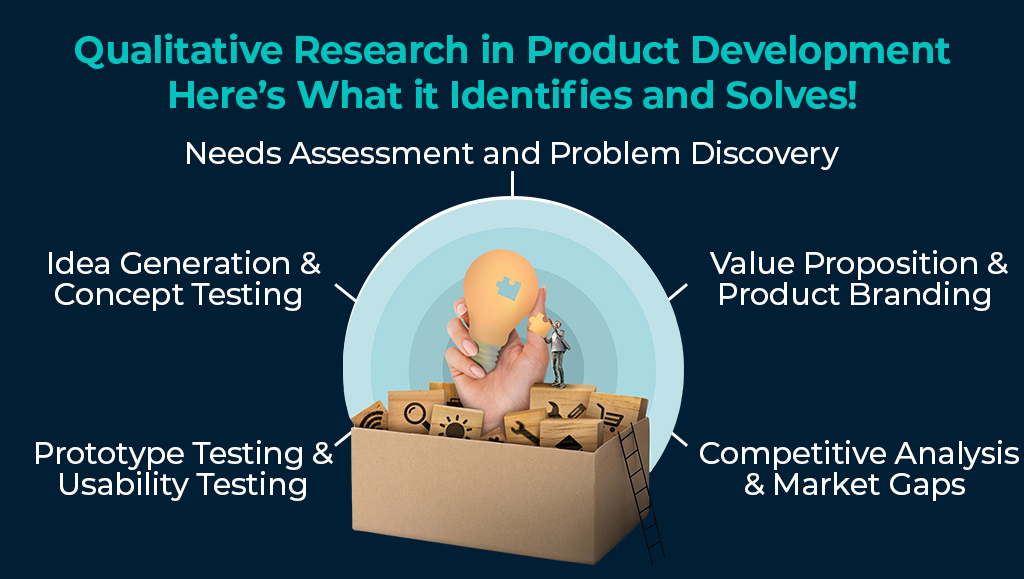

Solutions Qualitative Research Provides in Product Development

Qualitative research finds what people need, why they choose, and what blocks them from adopting your product.

- Needs assessment and problem discovery identify the real customer pain point, the decision drivers, and the adoption barriers that slow growth.

- Idea generation and concept testing convert rough ideas into tested product concepts, with clear reads on purchase intent, perceived value, and pricing perception using projective techniques and open-ended responses.

- Prototype testing and usability testing reveal task friction, language issues, and layout problems before code hardens, improving user experience with actionable prototype feedback.

- Value proposition and product branding align benefits to consumer needs and current brand perception, then verify words through message testing that supports the innovation process.

- Competitive analysis and market gaps map peer comparison, likely competitive response, and the market opportunity worth building for.

- We also surface motivation exploration, emotional drivers, and attitude study, then size product opportunity versus gaps through buying triggers, the purchase path, needs vs. wants, and the shopper journey.

From Discovery to Decision, Here’s How Qualitative Research Optimize Product Development!

Qualitative research workflow follows a two-sprint loop that turns research into a prioritized backlog, validated prototypes, and a ship-ready plan in four weeks. At Insights Opinion, our researchers rate it as the most practical way to align product development and market research, without slowing delivery.

Sprint 1: Discover (Weeks 1–2)

- Run 6–8 in-depth interviews per key segment plus one focus group to capture shared language.

- Add light ethnography/observation to see context and shopping behaviour, then layer social listening, opinion mining, and sentiment analysis for live phrases users already use.

- Synthesize with thematic analysis, empathy mapping, persona creation, and user stories to produce clear narrative findings.

Day-14 Outputs (Feed Your PRD): Problem statement, top customer pain points, key decision drivers, initial value proposition, risky assumptions to test, and draft success metrics.

Sprint 2: Decide (Weeks 3–4)

- Run early concept testing and prototype testing to complete a desirability study and concept refinement.

- Rank work with feature prioritization (value vs effort). Probe price sensitivity and create value mapping for the offer.

- Build persuasion mapping and run message testing for onboarding, pages, and ads.

- Close with a short validation study and a practical go-to-market plan.

Day-28 Outputs (Ready To Build & Launch): Prioritised backlog (epics → stories), tested flows and UX copy, price guidance, approved headlines, measurement plan (activation, adoption, retention), owners, dates, and a clear Definition of Ready/Done.

If you need multi-country recruiting or large validation samples, Insights Opinion, your qualitative market research company, coordinates with big market research firms while keeping synthesis tight and quality central. This lets optimizing product development stay fast and focused while your market research company delivers the scale you need.

Turning Insights from Qualitative Research into Product Decisions (What You Get & How It’s Used)

Qualitative findings only create value when they become build choices, copy, and launch plans your team can act on. We convert research into decision-ready artifacts and walk each owner through how to use them.

- Value Proposition & Positioning. You receive a one-page value proposition that links outcomes to benefits and proof. Product uses it to scope features. Marketing uses it to brief creative. Leadership uses it to align bets.

- Feature Prioritization. We deliver a ranked backlog with must-haves, satisfiers, and delighters, based on evidence from in-depth interviews, focus groups, and prototype testing. Engineering gets epics and user stories with acceptance criteria.

- Pricing Perception & Offer Design. You get price anchors, trade-off notes, and a simple value map. Growth uses this to frame tiers and bundles. Finance uses it to test revenue impact before launch.

- Message Testing & Persuasion Mapping. We hand over tested headlines, reasons-to-believe, and objection handlers. Design plugs these into onboarding, emails, and ads. Sales uses them as talk tracks.

- Experience Fixes. Usability testing outputs include friction points, copy changes, and flow recommendations. UX gets page-level fixes, error-state language, and task-success targets.

- Personas, Empathy Maps, And User Stories. Clear portraits of the target audience, their motivations, and decision drivers. Product, Design, and Content use these as shared guardrails so execution stays consistent.

- Go-To-Market Plan & Validation Study. A short GTM plan lists channels, messages, and success criteria. A follow-up validation study confirms adoption and retention signals post-release.

This is where product development and market research meet. As your qualitative market research company and hands-on qualitative marketing research agency, Insights Opinion turns conversations into a roadmap you can build, measure, and improve, keeping optimizing product development practical from sprint to launch.

Measure What Improved And Iterate (30/60/90 Plan)

Qualitative insight only wins when the numbers move. We pair narrative findings with a tight scoreboard and scheduled readouts. This ensures optimizing product development stays accountable from sprint to quarter.

- Baseline Before Changes. We log hypotheses, events, and targets, then capture a pre-change read on activation, task success, feature adoption, and early retention. This anchors the impact of our qualitative market research services.

- 30 Days: Activation And Time-To-Value. We check first-run completion, onboarding drop-offs, and top friction points seen in usability testing. Quick copy and flow fixes ship immediately, with clips and quotes to explain the “why.”

- 60 Days: Adoption Depth And Repeat Use. We review usage frequency, path analysis, and support topics. Short in-depth interviews validate purchase intent drivers and confirm which decision drivers now resonate.

- 90 Days: Retention And Revenue Signals. We read cohort retention, upgrade or referral behaviour, and price acceptance. We run a compact validation survey to size the winner, keeping product development and market research aligned.

Here’s What You Receive at the End of Each Cycle!

A one-page impact memo (metrics, clips, keep/fix/scale), a refreshed backlog, and a roadmap note for leadership. As your market research company and hands-on qualitative market research company, Insights Opinion maintains the feedback loop with rapid pulses, IDIs, intercepts, and social listening, so learning never stops.

Insights Opinion – Your Qualitative Research Partner

Insights Opinion is the qualitative research partner that ships decisions, not decks. ISO 20252 and ISO 27001 certified, we run global, multi-language studies and deliver PRD-ready outputs in four weeks so product, design, and growth move with confidence.

- End-To-End Ownership: Recruiting, moderation (IDIs, focus groups, ethnography, usability and prototype testing), analysis, and decision workshops handled by our senior team.

- Built For Product Teams: Our qualitative market research services plug into agile sprints and produce PRD-ready artifacts for product, design, engineering, and growth.

- Decision-First Deliverables: Value proposition, feature prioritization, price sensitivity notes, persuasion maps, message testing packs, personas, empathy maps, and a go-to-market plan.

- Four-Week Workflow: Discover (weeks 1–2) → Decide (weeks 3–4) → ship with a prioritised backlog, tested flows, and clear success metrics.

- Scale When Needed: Multi-country programs coordinated seamlessly; when scope expands, we align with big market research firms while keeping synthesis and quality central.

- One Partner, Many Skills: A market research company, qualitative market research company, and qualitative marketing research agency in one, so insight flows straight into design, copy, and launch.

- Governance And Quality: Hypothesis logs, method plans, risk registers, and tight QC ensure evidence you can defend and decisions you can build.

Book A Call With The Best Qualitative Research Partner Now!

Turn real conversations into build-ready decisions with Insights Opinion. In one call, we’ll scope your problem, pick the right methods, and map a four-week plan to PRD-ready outputs, value prop, prioritised backlog, tested messages, and a clear measurement plan.

What You’ll Get On The Call (Fast And Actionable):

- Problem definition and target audience shortlist,

- Recommended qual toolkit (IDIs, FGDs, usability, concept/prototype tests),

- Sample size, markets, and timeline,

- Deliverables checklist and ballpark investment.

Talk to our team now.

- US: +1 646 475 7865

- UK: +44 20 3239 5786

- India: +91 120 359 4799

Frequently Asked Questions

1) How does qualitative market research actually optimize product development in four weeks?

It runs two tight sprints: Discover (needs, barriers, language) and Decide (test concepts, prototypes, messages, price cues). You finish with a prioritised backlog, validated flows, value proposition, and a go-to-market plan that engineering and design can ship.

2) What sample sizes work for credible qualitative insight in this workflow?

Plan 6–8 in-depth interviews per key segment and one focus group for shared language, plus a handful of observation or usability sessions. That mix exposes patterns, not just opinions, and feeds a practical PRD.

3) What are the concrete deliverables we receive at the end of the engagement?

You receive a one-page value proposition, ranked backlog (epics → stories), tested UX copy and screens, price notes, message tests, a measurement plan, and a short go-to-market outline with owners and dates.

4) When should we add quantitative research to the process?

Use qual to find the “why” and define the winning route. Add a lean quant survey to size demand, confirm direction across markets, or support investment and capacity decisions before scale-up.

5) How do insights transfer into our PRD and sprint backlog without rework?

We map findings to user stories with acceptance criteria, attach copy kits and screen states, and record success metrics. Product, design, and growth get linked tasks that are ready to pull into the next sprint.

6) How is price sensitivity handled in a qualitative programme?

We probe anchors, trade-offs, and perceived value during interviews and testing. The output is a value map and pricing notes that guide packaging and tiers, which you can later validate with quant if needed.

7) Can this programme run across multiple countries and languages?

Yes. We recruit on-profile users in each market, moderate in local languages, and normalise outputs so decisions stay comparable. For very large rollouts we coordinate with trusted partners while keeping synthesis central.

8) How do you manage quality, privacy, and data security during research?

Senior moderators lead sessions, all participation is consented, and access to files is controlled. Our processes align to ISO 20252 for research quality and ISO 27001 for information security.